If you want to see what fires the grassroots passion for Donald Trump and Bernie Sanders, and the populist rebellion against the U.S corporate and political elite, take a look at the latest case of an American corporation’s gaming the system for handouts and bailouts and then walking out on Uncle Sam and all of us.

Back in 2009, Johnson Controls, a $33 billion maker of auto batteries and industrial-scale HVAC systems, wound up with a $100 million chunk of the federal bailout for the auto industry. In 2010, it got another $300 million federal grant to develop advanced battery systems. But now, Johnson Controls wants to duck out on U.S. taxes by renouncing its U.S. citizenship and shifting its legal residence to Ireland.

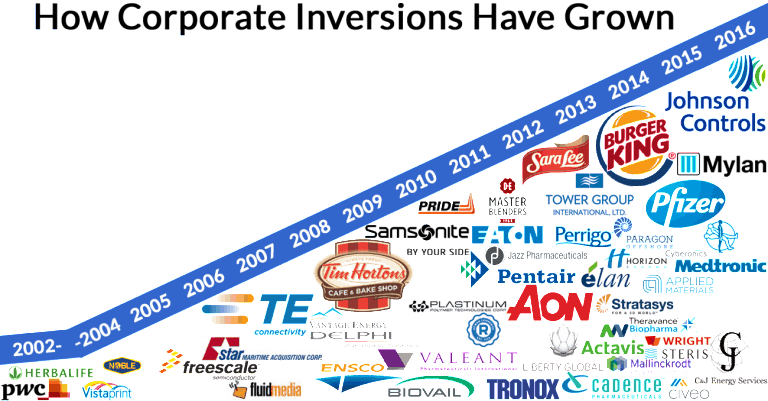

Like nearly 50 other U.S. multinational corporations over the past decade, Johnson Controls can dodge U.S. taxes legally through a corporate inversion – merging with a foreign company, Tyco International, based in Cork, Ireland. Tyco, too, was once a U.S. company based in New Jersey, but in 1997 it skipped out on U.S. taxes by merging with a foreign firm based in Bermuda.

Johnson Controls says it will save $150 million a year in U.S. taxes. And its CEO, Alex Molinaroli, gets a sweetheart payout of $20.5 million to $79.6 million over the next 18 months for making the deal. And if Molinaroli has to pay additional taxes as a result, the company will pay those taxes for him.

Crony Capitalism at Work

Oh, for instant replay in politics! You have to wonder if Congress had known this back in December 2008, how members would have reacted to the hard sell for an $80 billion auto industry bailout from former Johnson Controls President Keith Wandell, representing a major auto supplier.

“Speaking for our company, and, I am sure for all auto parts suppliers,” Wendell told the Senate Banking Committee, “we respectfully urge the members of this committee, and the Congress as a whole, to provide the financial support the automakers need at this critical time.” The collapse of even one U.S. carmaker, Wandell warned, would send shock waves through in the auto parts industry, spreading wars of layoffs.

Fast forward to 2011 and once again Johnson Controls was benefitting from a big federal grant to help it build and run an advanced lithium ion battery plant in Holland, Michigan. Visiting the plant, President Obama hailed the company as a technology leader and then made the point that America’s ability to sponsor private sector innovation means that “everybody’s got to chip in”, and that means “making sure that the biggest corporations pay their fair share in taxes.”

Steep Drop in Corporate Share of Tax Revenues

Obviously, that message fell on deaf ears. Johnson Controls has just become the 13th major U.S. corporation in the last 16 months to cut its tax bill through a foreign merger. Even before this latest wave, the Treasury Department estimated that corporate inversions will cost Uncle Sam $41 billion in lost tax revenues over the next decade.

But in truth, the corporate inversion game is just the latest strategem in a long-term trend that has eroded America’s corporate tax base. Since the 1950s, the corporate share of federal tax revenues has fallen steeply from over 30 percent to just 10 percent today – thanks not only to a lower corporate tax rate but to $1.2 trillion in corporate tax loopholes passed by Congress.

One reason is that foreign tax havens have become the new norm for corporate America. Major multinationals find financial hideaways like Bermuda or the Cayman islands where they set up shell affiliates, often little more than a small office with a big bank account, where they can stash their overseas profits and escape U.S. taxes.

In 2014, nearly three-fourths of Fortune 500 companies booked profits to foreign tax havens, according to a study by Citizens for Tax Justice and US PIRG. In all, U.S. companies were hoarding $2.1 trillion in profits offshore – enough to generate $620 billion in U.S. taxes if all those foreign earnings had come back home.