Negotiating with crazy people is always a bad idea and negotiating with hostage-takers is dangerous. But negotiating with crazy hostage-takers is worse than dangerously bad. The “debt-ceiling” deal being negotiated to keep the economy from being crashed could crash the economy anyway. Making draconian cuts could throw us into another recession -- one that would be much, much harder to get out of because we have used up many of our recession-fighting tools.

Withdrawing government spending literally “takes money out of the economy.” Democrats should instead offer the country a plan to invest in We, the People by modernizing our infrastructure, improving our schools, making us energy self-sufficient, improving our social safety net and restoring our manufacturing and key industries thereby making American businesses more competitive in the world economy. Propose this instead of painful cuts the benefit only the rich and take it to the country.

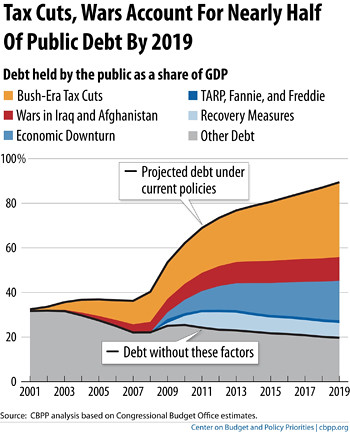

From Paying Off Debt To Massive Debt In Ten Years

Ten years ago the government had huge surpluses and was on a path to paying off the entire debt. What changed? Ten years ago last week the Bush tax cuts passed. Republicans promised the tax cuts would create jobs and grow the economy. Instead the economy had one of the slowest periods in our history, creating very few new jobs and causing stagnant wages, leading to huge personal debt. (But the rich got dramatically richer.) And those cuts, along with huge military increases, two wars all leading up to an economic crash caused by deregulation and mismanagement, caused the country's debt to exploded. Taking office with a surplus of more than $250 billion, Bush left office with a $1.4 trillion budget deficit for his final budget year.

Debt Limit Reached

Now the United States has reached the Congressionally-authorized borrowing limit and is heading towards default. The White House is negotiating an increase in this limit with the very people who exploded the debt, people who have a vested interest in killing the economy so they can win the next election, and their budget-cut proposals would do just that. It is suddenly dawning on lots of people that this whole enterprise of austerity, taking trillions out of the budget – and therefore out of the economy – is a very, very dangerous proposition.

Cuts Make Economy Worse

Withdrawing government spending literally “takes money out of the economy.” We have a crisis because of lack of demand. Republican solutions of giving the wealthy and corporations even more money and tax cuts obviously will not work because the rich don't create jobs, we do. The rich are already richer than ever, with a greater share of the income and wealth than ever, and giant corporations are already sitting on tons of cash.

So with the stimulus winding down, and state and local budget cuts causing layoffs of teachers, firefighters and other government employees, Republicans are demanding even more layoffs from federal budget cuts as a "cure." But cutting government as a prescription for creating jobs sounds a lot like their claim that cutting taxes increases revenue. The problem is a lack of demand, and budget cuts taking hundreds of billions out of the economy only makes that worse.

In a front-page story last week, Economy’s Woes Shift the Focus of Budget Talks, the NY Times sounded the alarm that things are not going well,

Recent signs that the economic recovery is flagging have introduced a new tension into the bipartisan budget negotiations, giving rise to calls especially from liberals to limit the size of immediate spending cuts or even to provide an additional fiscal stimulus.

... More broadly, however, the signs of an economic slowdown in past weeks — not least Friday’s report showing weak job growth in May — have altered the climate for those talks. Amid the emphasis in Washington on significant deficit reductions, ... some Democrats, economists and financial market analysts are raising concerns that too much fiscal restraint this year and next could further undermine the recovery.

Democrats are also noticing that agreeing to cuts demanded by Republicans could well have an effect on their chances in the next election.

“I think Obama himself is going to have to move or he’s going to risk losing the next election,” said Mark Weisbrot, a liberal economist and a co-director of the Center for Economic and Policy Research. “He’s going to have to say clearly that the federal government has to step in when the economy is so weak,” regardless of whether his proposals can pass in the Republican-controlled House.

Republican economist Martin Feldstein’s recent op-ed in the Wall Street Journal, The Economy Is Worse Than You Think, also warned how bleak the economy looks and what the prospects are. (Of course, Feldstein argues for Republican plutocratic solutions: cut taxes, Social Security and Medicare.) From the op-ed:

The drop in GDP growth to just 1.8% in the first quarter of 2011, from 3.1% in the final quarter of last year, understates the extent of the decline. Two-thirds of that 1.8% went into business inventories rather than sales to consumers or other final buyers. This means that final sales growth was at an annual rate of just 0.6% and the actual quarterly increase was just 0.15%—dangerously close to no rise at all. A sustained expansion cannot be built on inventory investment. It takes final sales to induce businesses to hire and to invest.

The picture is even gloomier if we look in more detail. Estimates of monthly GDP indicate that the only growth in the first quarter of 2011 was from February to March. After a temporary rise in March, the economy began sliding again in April, with declines in real wages, in durable-goods orders and manufacturing production, in existing home sales, and in real per-capita disposable incomes. It is not surprising that the index of leading indicators fell in April, only the second decline since it began to rise in the spring of 2009.

The data for May are beginning to arrive and are even worse than April's. They are marked by a collapse in payroll-employment gains; a higher unemployment rate; manufacturers' reports of slower orders and production; weak chain-store sales; and a sharp drop in consumer confidence.

Feldstein even agreed that the stimulus was not enough,

As for the "stimulus" package, both its size and structure were inadequate to offset the enormous decline in aggregate demand. The fall in household wealth by the end of 2008 reduced the annual level of consumer spending by more than $500 billion. The drop in home building subtracted another $200 billion from GDP. The total GDP shortfall was therefore more than $700 billion. The Obama stimulus package that started at less than $300 billion in 2009 and reached a maximum of $400 billion in 2010 wouldn't have been big enough to fill the $700 billion annual GDP gap even if every dollar of the stimulus raised GDP by a dollar.

The investment community is taking notice, too. From Reuters: Deficit cut would trim growth: BlackRock's Fink,

A $4 trillion reduction of the U.S. budget deficit, if enacted by Congress, would trim economic growth by one percentage point a year for the next decade, BlackRock (BLK.N) Chief Executive Laurence Fink said.

With analysts already forecasting modest growth of 2 percent to 3 percent annually, that would leave the United States with an economy expanding at only about 1 percent a year, Fink said at the Morningstar investment conference on Friday.

Fink, however, argues that the government should do it anyway, along with cutting corporate taxes.

Cuts Make Deficit Worse

In a blog post, Thoughts on Voodoo, Paul Krugman explains (with some math) why austerity right now doesn’t help, and only makes deficits worse,

There’s a quite good case to be made that austerity in the face of a depressed economy is, literally, a false economy — that it actually makes long-run budget problems worse.

[. . .]How big do these negative effects have to be to turn austerity into a net negative for the budget? Not very big. In my example, the real interest payments saved by a 1 percent of GDP austerity move are less than .02 percent of GDP; if the marginal tax effect of GDP is 0.25, that means that a reduction of future GDP by .08 percent is enough to swamp the alleged fiscal benefits. It’s not at all hard to imagine that happening.

In short, there’s a very good case to be made that austerity now isn’t just a bad idea because of its impact on the economy and the unemployed; it may well fail even at the task of helping the budget balance.

My recent post, See WHY Austerity Can't Reduce The Deficit links to the equations that explain the background of Krugman's (and others') concusion,

OK, so we have a $100 GDP with $10 deficits and we want to cut that to $5. Kash explains that a $5 spending cut means (by definition) that GDP immediately drops $5, and this (by definition) $5 drop in consumer income makes tax revenue drop as well (as well as a further drop in GDP). After some calculations (go to the post) Kash shows that a $5 cut makes deficits drop to 7.4%, not 5%, but GDP also drops quite a bit - maybe 7 or 8%. Seriously, go see the calculations, they are not difficult.

Just cutting people out of the economy doesn't fix the problem, it shifts the problem and eventually will kill the economy.

Stimulus Worked -- But Was Not Enough

Here is the timeline you see on this chart:

- First, there is the Bush freefall, from the policies Republicans want to return to

- then the effect of the stimulus spending reverses the decline, bringing back job growth

- then the stimulus winds down, and job growth levels out

- and combined with state & local budget cutbacks -- spending cuts, which Republicans want more of -- job growth stalls. (Note that this chart is private sector only doesn't show effect of government job losses.)

Jobs Fix Deficits

Jobs fix deficits. Restoring good-paying jobs starts to restore the tax base and stops the emergency spending on the unemployed. The increased demand as people find work and paychecks revives retail and manufacturing. Housing recovery, for example, depends on more jobs. But with unemployment high and wages are low, so many people just can't afford to buy -- or keep -- a house.

Only The "Pain Caucus" Benefits From Cuts

In the recent op-ed, Rule by Rentiers, Krugman explains that these budget-cut austerity policies help a small, select group. He calls them "the pain caucus."

The latest economic data have dashed any hope of a quick end to America’s job drought, which has already gone on so long that the average unemployed American has been out of work for almost 40 weeks. Yet there is no political will to do anything about the situation. Far from being ready to spend more on job creation, both parties agree that it’s time to slash spending — destroying jobs in the process — with the only difference being one of degree.

. . . Consciously or not, policy makers are catering almost exclusively to the interests of rentiers — those who derive lots of income from assets, who lent large sums of money in the past, often unwisely, but are now being protected from loss at everyone else’s expense.

. . . While the ostensible reasons for inflicting pain keep changing, however, the policy prescriptions of the Pain Caucus all have one thing in common: They protect the interests of creditors, no matter the cost. Deficit spending could put the unemployed to work — but it might hurt the interests of existing bondholders. More aggressive action by the Fed could help boost us out of this slump — in fact, even Republican economists have argued that a bit of inflation might be exactly what the doctor ordered — but deflation, not inflation, serves the interests of creditors.

[. . .] No, the only real beneficiaries of Pain Caucus policies (aside from the Chinese government) are the rentiers: bankers and wealthy individuals with lots of bonds in their portfolios.

Cuts Cold Cost Election

Policies of austerity cause large-scale suffering -- done now to avoid restoring tax rates at the top. Budget cuts are asking the public to take the hit, through cuts in programs for us, for among other things the cost of bailing out Wall Street.

Republicans understand that the public will blame Obama for the cuts and are certainly planning on using the resulting lack of jobs in the next election. Remember, in the 2010 midterms they campaigned and won using a theme that Democrats were to blame for “$500 billion in Cuts to Medicare”.

The conservative noise machine is already claiming that Obama is harming Social Security. For example, see last week's Obama busting Social Security by conservative Don Surber,

Having cut employee contributions by one-third, the president now wants to cut employer contributions in a desperate CYA to cover up the Obamess Economy.

Public Wants A Different Solution

The American Majority wants the same solutions that economists agree work better for more people. The public wants tax increases on the rich. They want direct job creation by government. They want a revival of American manufacturing. They want a national industrial/economic policy. They understand that growing the economy reduces the deficits.

Austerity is about intentionally causing suffering, so a wealthy few benefit. But investing in our country to create jobs, modernize our infrastructure, improve our schools, make us more energy self-sufficient will not only make our country more competitive in the world economy will improve the lives of We, the People. Obviously this is the better choice, and a significant percentage of the public will have Democrats' back if they offer this plan.

The Congressional Progressive Caucus' People’s Budget is the template for a job-creating deficit solution. The Progressive Caucus is a group of progressives in the Congress who have put together a budget that fixes the deficit and grows the economy, providing jobs. It is called The PEOPLE'S Budget Plan. You can read the plan at: Congressional Progressive Caucus : FY2012 Progressive Budget,

The CPC proposal:

• Eliminates the deficits and creates a surplus by 2021

• Puts America back to work with a “Make it in America” jobs program

• Protects the social safety net

• Ends the wars in Afghanistan and Iraq

• Is FAIR (Fixing America’s Inequality Responsibly)What the proposal accomplishes:

• Primary budget balance by 2014.

• Budget surplus by 2021.

• Reduces public debt as a share of GDP to 64.1% by 2021, down 16.5 percentage points from a baseline fully adjusted for both the doc fix and the AMT patch.

• Reduces deficits by $5.6 trillion over 2012-21, relative to this adjusted baseline.

• Outlays equal to 22.2% of GDP and revenue equal 22.3% of GDP by 2021.

Beyond the people's budget we need a massive investment in infrastructure modernization. This infrastructure work has to be done anyway, no matter what. The longer we delay it the more our country falls behind. It is millions of jobs that need doing at a time when millions need jobs! (And by the way the government can borrow at nearly zero interest rates right now -- one more reason to do it now.)

The Republicans are demanding that we cut and gut our government and therefore our economy in exchange for keeping the country from defaulting on its debts. The deal they are demanding will do just as much harm as default. Instead we need to invest in We, the People with jobs and infrastructure that enable us to grow our way out of this mess.

Actions

Tell President Obama to put the People's Budget on the table.