Will Obama's transformative budget survive? As his press conference last night illustrated, it runs a serious risk of drowning in a swamp of cant.

The budget is getting strafed by politicians in both parties for its deficits and debt. (The deficit is the annual shortfall between revenue and spending; debt is essentially the accumulation of net deficits over time).

Republicans, having joined Rush Limbaugh in betting that Obama fails, have done most of the ranting. Sen. Judd Gregg, lead Republican on the Senate budget committee, fulminates that if we pass Obama's budget, "this country will go bankrupt. People will not buy our debt. Our dollar will become devalued."

Richard Shelby, top Republican on the banking committee, warns Cassandra-like that Obama's budget will put the country on "the fast road to financial destruction." Eric Cantor, the hyperbolic House Republican Whip, brings it down to his favored level, railing about wasteful spending like "money that goes to remove pig odor."

Conservative Democrats are chiming in also. Sen. Evan Bayh has formed what must be the twentieth new democratic rump group, arguing that "families and businesses are tightening their belts to make ends meet -- and Washington should too." Kent Conrad, Democratic head of the budget committee, is pushing for deep cuts in spending on domestic programs. "Moderate" Senators are expressing growing opposition to the president's spending plans. Even the Chinese, America's biggest creditor, are wringing their hands about U.S. deficits, suggesting perhaps a new international currency might be needed to replace the dollar.

Before this babble completely drowns out reason, a little common sense might be useful.

1. The new-found Republican fiscal probity is worth less than a drunkard's morning-after regret.

For the last decade, they merrily embraced the Dick Cheney dictum that "Reagan taught us that deficits don't matter. They doubled the national debt when the economy was growing, exactly at the height of the business cycle when they should have moved budgets into balance and reduced debt burdens. Fully $1.4 trillion of the largest annual "Obama" deficit -- the $1.8 billion the CBO projects for FY 2009 that ends this October -- was bequeathed to him from George Bush; the remainder comes from worsening conditions and the Obama stimulus spending to put people back to work..

Now as the economy verges on a depression, Republicans are indicting Obama for raising spending and deficits. This is like a gambling addict squandering the family fortune in a Las Vegas blowout and then scolding his wife for borrowing money to keep the kids in college. Had Republican leaders any sense of decency, they would just shut up and let adults address the mess they have left.

2. The greater worry in the short term is that the deficits may be too small, not too large.

We've just suffered what Warren Buffett calls an "economic Pearl Harbor." The accelerating downturn is turning into a global collapse. Consumers are cutting back; businesses laying off workers; exports have plummeted. The Fed has already cut interest rates to near zero. The only thing lifting this economy is deficit spending at the federal level. Senators intoning the comfortable mantras of the last years like Even Bayh can't seem to grasp that we're in a big-time trouble. If we took his advice, and cut federal spending and deficits, it would simply contribute to a downturn that is already the worst since the 1930s.

That's why the high-church of economic conservatism, the International Monetary Fund, is calling on countries across the world to borrow more to stimulate the economy, not less. And that's why all the talk about deficits in the out years -- six, eight, ten years from now -- is simply a dangerous distraction. The Congress isn't passing the budget for a 2019. It is passing one for next year, and it should be spending more, not less, to put people to work and get the economy going. Once the economy recovers, we can act to bring deficits down to a sustainable level.

3. We can afford to take on the debt.

Before joining Judd Gregg in rending garments and mumbling darkly about the end of the world, legislators would be well advised to inhale deeply, calm themselves and look around. The Congressional Budget Office predicts budget deficits will total some $9.3 trillion over 10 years (Obama's budget which is more optimistic about the pace of recovery projects $6.97 billion). That's a lot of money.

But this is a very big economy at $15 trillion a year and hopefully soon growing again. Bill Gates undoubtedly carries more debt than I or you do. But the burden of that debt -- the carrying charges in relation to his income or the debt in relation to his assets -- is far less than mine or thine. He can afford to take on more debt.

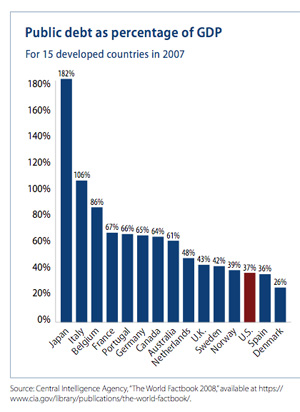

After years of conservative misrule, the US isn't in as good shape as Bill Gates, but it isn't broke either, particularly in comparison to other industrial nations. The current US public debt is about 40% of our annual economic production (GDP). It's been far higher -- reaching as much as 109% of GDP coming out of World War II. Post-war growth brought the burden down to about 25% GDP until Reagan gave us over to the seductive supply-siders and doubled the debt burden to about 49% GDP. Clinton brought it down to 33% and Bush drove it back up to about 40% even though the economy was growing.

Under Obama's plans, the national debt will rise as a percentage of the economy to about 65-67%. That's a big change. But the reason countries carry low levels of debt is so they can borrow when trouble comes. And this is the mother of all trouble.

But what is notable about that increase is that it will leave the US carrying only about the same debt burden that Germany, France and Canada were carrying -before they began adding to it in the current economic downturn. According the analysis of the Central Intelligence Agency in 2008, Germany's public debt was at 65%, France at 66%, and Canada at 64%. The Italians, always somewhat more fiscally dissolute, were at 106%. Sober Japan, coming out of its lost decade, carried a public debt that was182% of its country GDP.

None of these countries are going bankrupt. The Euro isn't turning into toilet paper. The Japanese haven't boarded up the country. We are urging all of these countries to borrow and spend more to help counter the downturn. We can afford the Obama deficits and more if necessary to lift us out of what looks increasingly like a global depression. (And that's why if the Chinese are looking for a new currency to supplant the dollar, they'll have to invent it.)

4. The most dangerous deficit is our public investment deficit.

Fact is we can't really afford to cut the public investments Obama would make in education, new energy, health care and 21st century infrastructure. For too many years, we've starved basic investments to pay for adventure abroad or top end tax cuts at home. Now we have a national security imperative to invest in new energy, reduce our dependence on foreign oil and begin to address catastrophic climate change. We can't compete as a high wage economy in a global economy without providing our children with a world-class pre-K to college (or advanced training) education. We must make the changes needed to provide Americans affordable high quality health care while getting health care costs under control. And we've paid the costs everyday of allowing our basic infrastructure to decay -- from unsafe water to gridlocked roads to falling bridges to the outmoded electric grid.

Obama's budget and recovery plans run up deficits to put people back to work while making a down payment on investments vital to our future. His domestic spending plans are, if anything, already too austere, reducing domestic discretionary spending to a lower percentage of the economy than under Reagan or Clinton or the Bushes. He argues correctly that we have to make investments in these areas to move our economy to sustainable growth, and away from the disastrous bubble economy that has now exploded in our faces. It is notable that his Republican critics don't dispute him on this point. They simply stand firm against any tax increases on the wealthy, while calling for cutting spending to reduce the deficits -- without ever offering a budget of their own to let us know exactly what it is they think should be cut.

The lesson? Let's make certain we spend enough to get this economy going. Once we do that, we must guard against making Roosevelt's mistake of trying to balance budgets too quickly, driving the economy back into the pits, as he did in 1937. Ignore the hyperventilating about America's pending bankruptcy. But let's make certain we stop spending money on pig odor, or whatever it is goofy Eric Cantor is whining about.