Symphony, a planned chat system being developed on behalf of Wall Street's biggest institutions, has a ton of fancy new features. You can personalize filters, share trading algorithms, prevent “government spying,” and much, much more!

Wait, about that last one....

Are they talking about Chinese or Russian hackers? Our own intelligence agencies? Or, as Massachusetts Sen. Elizabeth Warren has asked in a letter to the Consumer Financial Protection Bureau, could it be they also mean the regulators whose job it is to keep the rest of us from being fleeced?

Symphony currently advertises itself as an "open, secure, cloud-based, communications platform that connects markets and individuals, promoting collaboration and workflow productivity while maintaining organizational compliance."

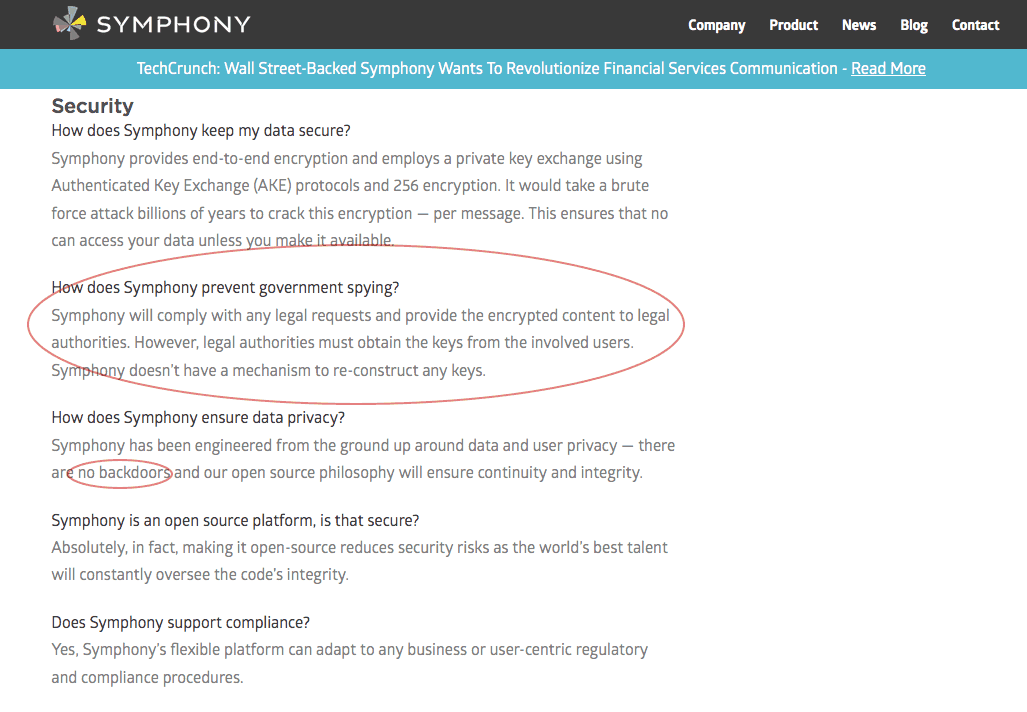

How this platform was supposed to work had been explained on the company's website under their FAQ section, which appears to have been taken down at the same time its features were catching the attention of some watchdogs. The wording leaves little room for nudging and winking: Authorities can get encrypted information but that's gibberish without the encryption keys that enable the content to be actually usable.

Knowledge that your chats can’t be read by regulators opens up a whole new world of potential insider information and illegal collusion. This may also count as destroying the evidence, which is why the New York Department of Financial Services contacted Symphony and demanded explanation as to how, exactly, this is not breaking the law.

Chat rooms have a history of landing firms in trouble. As Warren pointed out in her letter, many banks were incriminated in the LIBOR rate-rigging scandal in 2013 only by regulators who were able to trawl through traders’ chats and messages. The LIBOR scandal involved banks manipulating the London Interbank Offered Rate, which trillions of dollars in investments are tied to, and resulted in $6 billion in fines and an actual prison term.

Later that year, a similar scandal was discovered where traders around the world colluded to manipulate currency exchange rates. The case was investigated and then prosecuted using evidence found in messages and chat rooms.

When firms collude and cheat based on insider information, it is at the expense of the outsiders, the small-time traders, the less well-connected who are out of the loop. In many cases, that means us, who have money in pension and savings funds. And if Symphony had existed in 2013, traders would still be messaging each other through chat rooms titled ‘the bandits club” and “the cartel,” cheating the rest of us out of tens of billions a year.