According to the U.S. Commerce Department the massive U.S. trade deficit jumped 7.6 percent in September, draining another $43 billion from our economy in a single month. U.S. exports fell to their lowest in five months. Meanwhile, August's trade deficit was revised down from the reported $40.11 billion to $39.99 billion.

That means that in September $43 billion of U.S. "demand" was satisfied from outside the country. So $43 billion of jobs and wages and business went elsewhere.

Several factors combined to cause this. Europe's economy is still suffering from depression as European Union governments continue to tighten budgets, which takes money out of their economies, slowing potential growth. The U.S. dollar is up 4 percent because people want their savings in dollars in uncertain times, which means U.S. goods cost more in world markets.

Another factor causing the dollar to rise is that several countries notoriously manipulate their currencies to weaken them against the dollar, which also makes U.S. goods cost more in world markets. Slowing world demand and the "strengthening" of the U.S. dollar cause U.S. imports to rise and exports to fall.

U.S. exports to Europe were down 6.5 percent in September. China's amazing growth rate has slowed a bit to "only" 7.3 percent, and exports to China fell 3.2 percent. Exports to Japan fell 14.7 percent; the trade deficit with Japan was $5.3 billion.

The trade deficit with China hit $35.6 billion, an all-time high.

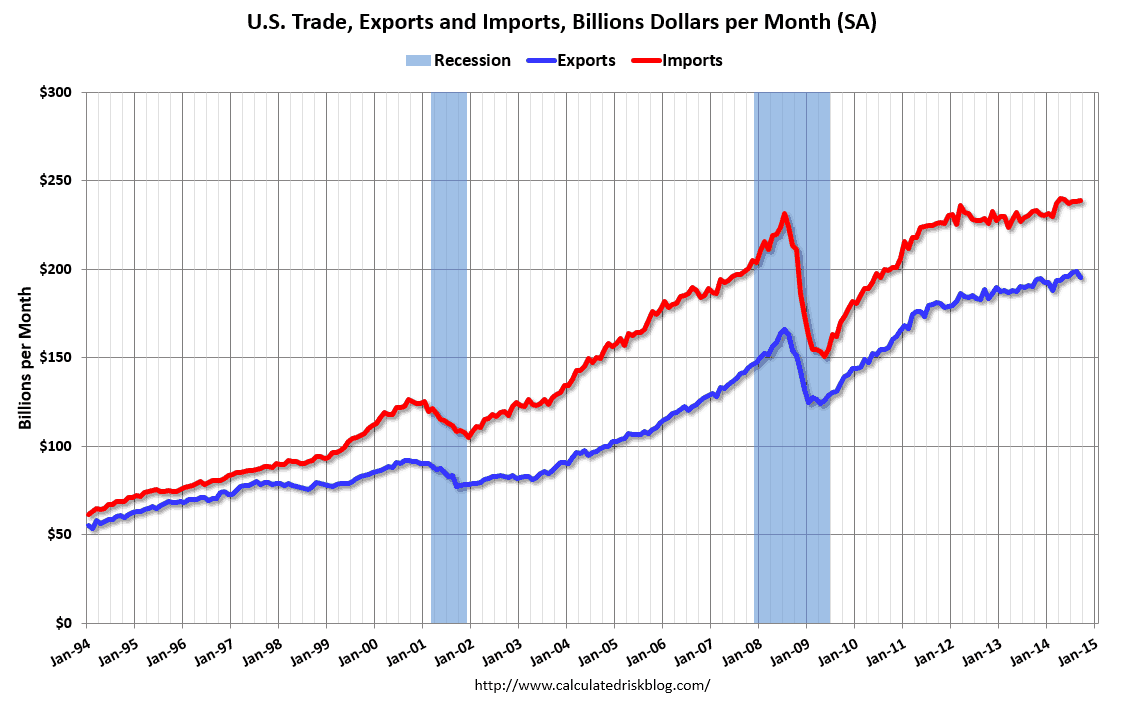

This chart from the Financial Times shows the rate of monthly trade deficits since 2010, draining $40 billion-$50 billion each month.

This chart from Calculated Risk shows the longer trajectory of more imports than exports.