From the perspective of the federal government, tax breaks are no different from any other kind of federal spending. Just like money we spend on programs such as early childhood education or food safety, when we approve tax breaks, it means less money in the U.S. Treasury to spend on other things.

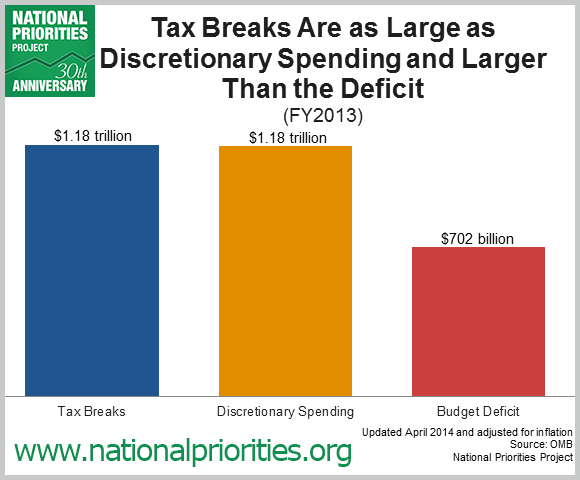

Let’s talk about the size of current tax breaks. According to a new report by the National Priorities Project, the federal government spent an astounding $1.18 trillion on tax breaks in 2013 – the same amount it spent on the entire discretionary budget. That means for every dollar we spent on education programs, our nation’s parks, nutrition programs, our veterans – all of it – we lost a dollar of tax revenue due to these tax breaks. If there were no tax breaks in 2013, we may have actually run a surplus and not a budget deficit.

And while tax breaks siphon off more than $1 trillion every year, tax breaks themselves receive very little or no oversight by lawmakers once they are written into the tax code.

And while tax breaks siphon off more than $1 trillion every year, tax breaks themselves receive very little or no oversight by lawmakers once they are written into the tax code.

Right now congressional leaders in the House of Representatives are working on making six so-called “tax extenders” – a set of corporate and other tax breaks – permanent without providing an offset. Ending these six tax extenders would provide the federal government billions in much-needed revenue over the next 10 years. These tax extenders signal a pressing need for Congress to tackle comprehensive tax reform, yet they are only a small part of the overall cost of tax breaks.

Meanwhile, leaders in the House of Representatives are refusing to vote on a bill that would reinstate unemployment insurance benefits to millions of long-term jobless workers because they claim it would cost too much, despite being paid for.

For more on the extent of our nation’s tax breaks and how they have grown in both number and size over time:

- Explore NPP’s top ten tax breaks in our interactive visualization;

- Download our updated time series dataset: the estimated cost of every tax break between 1974 and the present; and

- Read NPP’s report highlighting key analysis from the data.