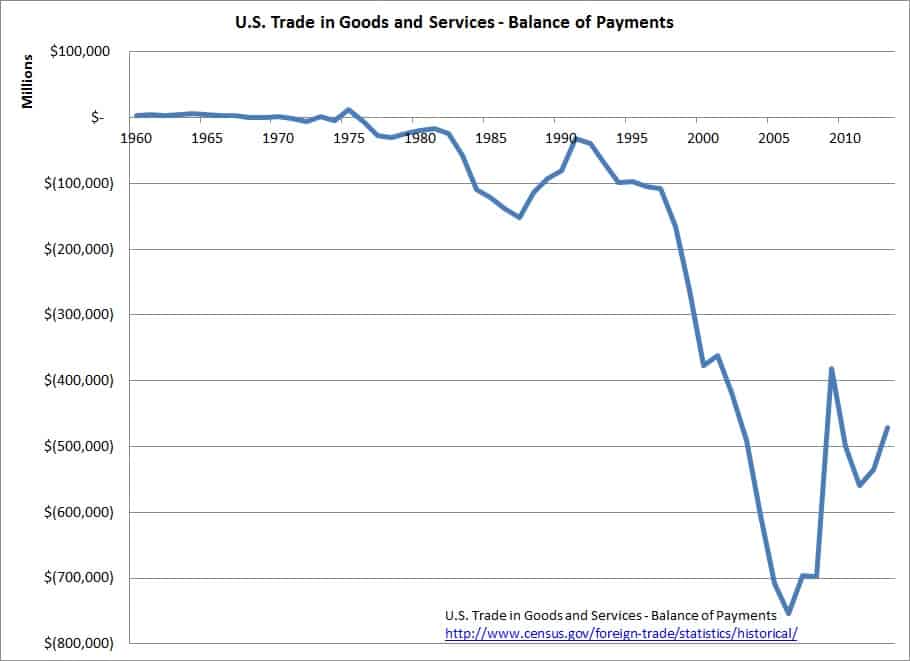

The enormous, humongous trade deficit is doing incredible damage to our economy. Our country's elites used to care about that.

In 2003 Warren Buffett wrote a highly-influerntial article, America's Growing Trade Deficit Is Selling The Nation Out From Under Us. Here's A Way To Fix The Problem--And We Need To Do It Now. Buffett began, "I'm about to deliver a warning regarding the U.S. trade deficit and also suggest a remedy for the problem." Then he added, "... our country's 'net worth,' so to speak, is now being transferred abroad at an alarming rate."

To make his point, Buffett used a hypothetical example of "two isolated, side-by-side islands of equal size, Squanderville and Thriftville." Thriftville lived off the food they grew, and worked extra time so they could export food. The people in Squanderville stopped working and issued IOUs so they could just buy food from Thriftville, thinking "they can now live their lives free from toil but eat as well as ever."

Of course, Squanderville couldn't issue IOUs forever to buy Thriftville's food. Eventually Thriftville owned all of Squanderville and the people there had to start working 16 hours a day to make up for the work they hadn't done. And because Thriftville now owned Squanderville, the long hours would continue forever, generation after generation.

The 2002 US trade deficit that had Buffett sounding this alarm was $417.4 billion -- an enormous, humongous number. By 2005 it reached $708 billion. The Great Recession knocked that way down, as we stopped being able to buy so much, but we made no changes in our trade policies and recovery returned it to $560 billion in 2011. It is down to $470 billion now, largely because the oil and gas boom reduces imports. (And lower oil and gas imports do not reopen factories, etc.)

Buffett went on to explain how the trade deficit is affecting us.

In effect, our country has been behaving like an extraordinarily rich family that possesses an immense farm. In order to consume 4% more than we produce -- that's the trade deficit -- we have, day by day, been both selling pieces of the farm and increasing the mortgage on what we still own.

When You Sell The Farm, The Jobs And Ability To Make A Living Go Away

When a family sells off the farm to a housing developer the members of the family might put a bunch of cash into their bank accounts, but all the people working at the farm are out of a job and the surrounding community loses its ability to grow food to eat in the future. That is what our country is doing. That is the inequality we are experiencing. The trade deficit is a few people selling off our jobs and ability to make a living in the future. They get really rich, and the rest of us lose everything in the long run.

To put the huge trade deficit in perspective, picture our economy if $470 billion of orders came in right now to companies that make or do things inside the US. Picture the factories reopening, the people hired, the suppliers thriving, the communities reawakening, the tax revenues filling up government coffers, etc. That is the harm that this trade deficit is doing, because those things are not happening. That is the harm done when we borrow so we can buy things made elsewhere.

The trade deficit has been draining our wealth. It is the main reason the economy is having so much trouble. The unequal distribution of our wealth is part of the problem, too, but only part. In other words, right now we are unequally redistributing less and less wealth. Our economic problem is not the budget deficit, the budget deficit partly results from the trade deficit.

The trade deficit is a few rich people selling the farm that grows the food we eat and where the rest of us work.

The Buffet Plan

Buffet proposed a simple plan to balance our trade. The government could issue "Import Certificates (ICs) to all U.S. exporters in an amount equal to the dollar value of their exports." The number of import certificates determines the level of trade imbalance or balance that we allow.

Each exporter would, in turn, sell the ICs to parties--either exporters abroad or importers here--wanting to get goods into the U.S. To import $1 million of goods, for example, an importer would need ICs that were the byproduct of $1 million of exports. The inevitable result: trade balance.

The idea was sort of like cap-and-trade. Exporters would get a certificate for the value of their exports. The certificates allow anyone holding them to import that dollar amount of goods or services. So selling these certificates would mean extra cash to exporters, and would help them modernize factories, pay specialists and the other things needed to revive our in-country industries. Or the extra cash would let them sell for less, which would counter currency manipulation and other subsidies that other countries provide to their exporters.

There are a number of pluses and minuses, and Buffett goes on to list some of the negative effects of balancing trade. For one thing, prices would necessarily go up. But, of course, jobs and wage gains would return to our economy.

Buffett closes by saying we need to stop wishful thinking about the trade deficit.

Perhaps there are other solutions that make more sense than mine. However, wishful thinking--and its usual companion, thumb sucking--is not among them. From what I now see, action to halt the rapid outflow of our national wealth is called for, and ICs seem the least painful and most certain way to get the job done.

Variations On The Buffett Plan

Senators Russ Feingold and Byron Dorgan proposed the The Balanced Trade Restoration Act of 2006, similar to Buffett’s plan. The bill warned, "The surging trade deficits could soon create a balance of payments crisis for the United States, which could wreak havoc with the economy of the United States." The bill didn't go anywhere.

A 2008 paper from the Levy Institute, The Buffett Plan for Reducing the Trade Deficit suggest that the government auction import certificates and use the revenue to offset the negative effects of the initial transformation back to an exporting economy.

A 2009 paper from the Economic Policy Institute (EPI), Addressing Balance of Payments Difficulties Under World Trade Organization Rules says that government auctioning of Import Certificates would be more consistent with WTO rules than letting companies sell them to exporters. According to the paper,

Warren Buffett’s trade balancing proposal would bring the chronic U.S. trade deficit into balance by creating import certificates equal to the value of U.S. exports. These certificates could be granted to exporters and sold by them on the open market, or they could be auctioned by the government through a certificate market. While the first method would provide benefits to exporters, the second method would help reduce or eliminate potential inconsistencies with WTO prohibitions on export subsidies.74 In addition, the second method could generate a stream of revenue for the government.

In a 2011 article, "What Would Buffett Do? — A Plan to Balance Trade, Create Jobs and Restore American Manufacturing," Bill Parks goes into detail on a similar plan, and suggests a mix of private and public sale of the import certificates. He also suggests that the government could adjust the ratio of exports to imports as needed.

We Have To Balance Trade Somehow

It should be noted that in a free market these trade imbalances would be at least partly addressed by currency rates moving to market levels. America's dollar would weaken, moving prices low enough that we would start selling much more of what we make and do. But countries like China and others are benefitting from this trade imbalance and are keeping their currencies from adjusting. And there are beneficiaries inside of our own country -- Wall Street, giant multinationals an others -- who are benefitting from the status quo. So the vast imbalances continue.

The Buffett Plan was just one idea for balancing trade. But balance we must. As Buffett warns, these huge trade deficits cannot be sustained. They are draining our economy. There has to be a reckoning. We have not faced that reckoning yet, but it is inescapable. It has to happen. We have to tackle this as a country, with a national plan.