We’re in the midst of the worst employment crisis in modern memory. Lackluster jobs reports like last week’s should remind us that the crisis will last a long, long time unless we act. It would be tragic if superficial "improvements" created by discouraged workers dropping out of the labor force become an excuse for continued inaction – or worse.

But buried in the discouraging data are figures that could become the seeds of a new intergenerational alliance.

Generation Gap

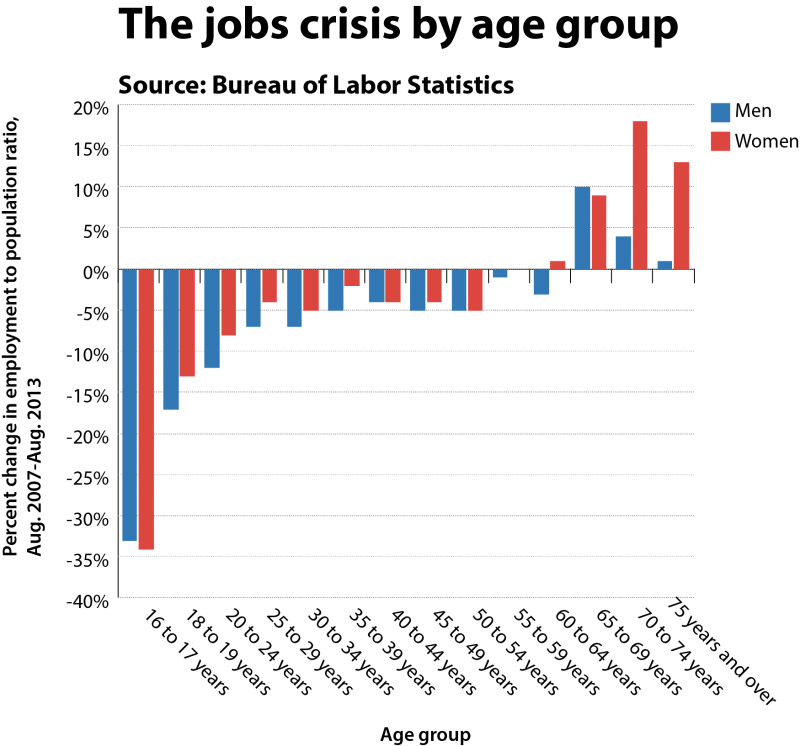

Some of those numbers can be found in this chart, from the Bureau of Labor Statistics:

It shows that the financial crisis of 2008 has had a devastating impact on employment for adult Americans under 65, a time of life once described as “working age.” The crisis has been most severe for teenagers, then for people in their 20s. The figures stabilize at grim but less severe levels for Americans up to the age of 60.

Then something significant happens. At the age of 60, men have continued to experience job loss. But more women are employed now than were working before the financial crisis. From the age on 65 upwards, both sexes are more likely to be working now than before the crisis.

The figures are especially striking – and disturbing – for women. Women between the ages of 65 and 70 are more than 15 percent more likely to be working now, and women over 70 are more than 10 percent more likely to be on the job.

Vanishing Point

This doesn’t mean employers have suddenly developed an enthusiasm for hiring elderly men and women to fill their job vacancies. In all likelihood, these numbers mean that fewer aging Americans have the financial means to retire.

There was a time in the not-so-distant past when working people were able to consider retirement at the age of 60 or 62 (the youngest age for collecting early Social Security benefits.) But households that saw their net worth gutted by the financial collapse can no longer consider that option.

What’s more, Social Security benefits in this country are quite low when compared to those of other developed countries. The loss of net worth in the 2008 crisis, coupled with corporate America’s abandonment of defined pension benefits, has left seniors more dependent on those benefits than ever before.

It’s highly unlikely that these older Americans are getting hired for new jobs. They’re hanging on to the jobs they have, because they have no other choice. Retirement is a mirage that recedes as they approach it, until it disappears in a vanishing point of ongoing hardship. That’s painful for them, and it makes the unemployment situation for younger people even worse.

There is No War

The real message behind these figures is: We’re all in this together. Younger Americans desperately need jobs. Older Americans don’t have the financial means to retire.

The corporations and wealthy individuals backing efforts like “Fix the Debt” want to cut Social Security. They also oppose investing government resources in job creation and economic growth. They’ve spent hundreds of millions of dollars in public relations money trying to convince us there’s a generational war taking place between “greedy geezers” and American youth.

Their paid minions, like Alan Simpson and Erskine Bowles, are trying to deceive us. They’re being financed by Wall Street interests like hedge funder Pete Peterson and megabanks, like Goldman Sachs and JPMorgan Chase. And here’s a quick reminder: It was Wall Street that caused the financial crisis of 2008, not “greedy geezers” or Twitter-obsessed young people (as Simpson once described them).

Now they’re trying to convince us that Social Security should be turned over to the same banks that crashed the economy once before. They’re trying to protect tax breaks for themselves, and excusing it by claiming the government spending can’t create jobs or heal an economy. But government spending has done exactly that, in decade after decade. It’s a proven technique.

As Paul Krugman likes to say, “We know how to fix these problems. It’s not rocket science.”

A New Alliance?

The fight to protect America’s elderly is the same fight that must be waged for the young. It’s the fight to increase, not decrease, Social Security benefits (which even the youngest American will hopefully collect one day). It’s the fight to invest in jobs now, so that America’s young can begin their work lives and enjoy them more prosperously. It’s the fight for fair taxation and an end to exploding inequalities in income and wealth.

There is only one fight, and it’s everybody's fight.

This week’s numbers are grim, but the message behind them should forge a new alliance. It’s a message that reinforces what’s best about us as a society. Young or old, black or white, rich or poor: When times are hard, we help each other.