The Walton (Walmart) heirs now have as much wealth as up to 40 percent of all Americans combined, and Walmart's sales have been slowing down. What does the first fact have to do with the second? (Hint: Sign this petition for raising the minimum wage.)

The top 1 percent now rakes in 20 percent of the nation's income and holds one-third of the country's wealth. Meanwhile the economy remains stagnant because the incomes of regular people are stagnant and falling – meaning they can't buy stuff and can't invest in their own futures.

From the post "40% Of Americans Now Make Less Than 1968 Minimum Wage":

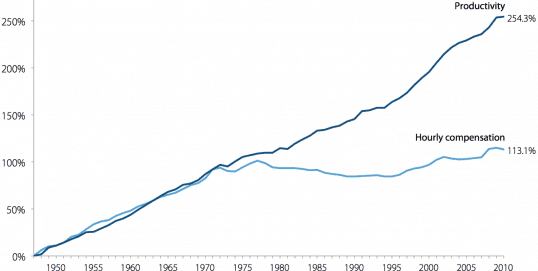

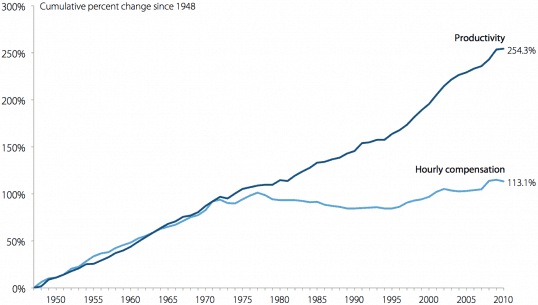

The chart shows that wages used to go up as productivity went up, but in the 1970s they decoupled. Productivity kept going up but wages stagnated.

Regular people's incomes have been stagnant since the 70's while costs keep going up. In fact, 40 percent Of Americans now make less than the 1968 minimum wage if that minimum wage had kept rising along with productivity. If the minimum wage had stayed coupled to productivity the minimum wage would now be $16.50 an hour – which more than 40 percent of Americans now make!

Instead all of those people's possible additional income went to the top. And that plus changes in taxation is why we have the inequality we have. That is what happened to our economy and to all of us.

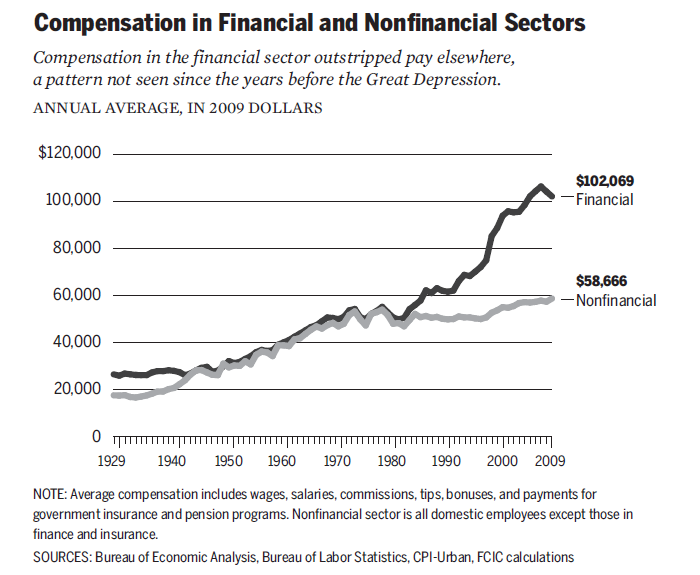

Now, here's another chart. This chart shows that financial-sector and non-financial-sector compensation used to rise together, but in the late 70's / early 80's they decoupled. Financial-sector compensation took off, while non-financial-sector compensation did not.

It is as simple as this: If we want our economy and democracy to recover, the minimum wage needs to be raised as a core part of the solution. (But only part.)

Sign this petition calling for “the leaders of the House and Senate to allow an up-or-down vote on the Fair Minimum Wage Act of 2013, which would raise the minimum wage to $10.10 an hour and then index it to inflation.” While $10.10 is too low, it's a start, and it is what is before the Congress. There are other essential things we need to do, but we need to raise the minimum wage to set a floor that is not falling out from under us.

Inequality Holding Back Recovery

The recovery from the economic crash is stagnant, and unemployment remains in emergency territory.

In January Economist Joseph Stiglitz wrote this op-ed for The New York Times, listing four reasons why the terrible inequality we face today is holding back the recovery, "Inequality Is Holding Back the Recovery":

There are four major reasons inequality is squelching our recovery. The most immediate is that our middle class is too weak to support the consumer spending that has historically driven our economic growth. While the top 1 percent of income earners took home 93 percent of the growth in incomes in 2010, the households in the middle — who are most likely to spend their incomes rather than save them and who are, in a sense, the true job creators — have lower household incomes, adjusted for inflation, than they did in 1996. The growth in the decade before the crisis was unsustainable — it was reliant on the bottom 80 percent consuming about 110 percent of their income.

Second, the hollowing out of the middle class since the 1970s, a phenomenon interrupted only briefly in the 1990s, means that they are unable to invest in their future, by educating themselves and their children and by starting or improving businesses.

Third, the weakness of the middle class is holding back tax receipts, especially because those at the top are so adroit in avoiding taxes and in getting Washington to give them tax breaks. The recent modest agreement to restore Clinton-level marginal income-tax rates for individuals making more than $400,000 and households making more than $450,000 did nothing to change this. Returns from Wall Street speculation are taxed at a far lower rate than other forms of income. Low tax receipts mean that the government cannot make the vital investments in infrastructure, education, research and health that are crucial for restoring long-term economic strength.

Fourth, inequality is associated with more frequent and more severe boom-and-bust cycles that make our economy more volatile and vulnerable. Though inequality did not directly cause the crisis, it is no coincidence that the 1920s — the last time inequality of income and wealth in the United States was so high — ended with the Great Crash and the Depression. The International Monetary Fund has noted the systematic relationship between economic instability and economic inequality, but American leaders haven’t absorbed the lesson.

Translation:

- Top 1 percent (a few people) taking most of the gains, income in the middle (lots of people) is falling, they can't buy stuff.

- Middle class disappearing, unable to invest in education or start businesses.

- Tax system rigged so gains going to 1 percent not bringing revenue to government, with incomes to the rest falling, revenue to government decreasing. Government can't afford to invest in infrastructure, research, education, health and other things the help economy.

- Inequality that drives such massive amounts to a top few makes even the rich feel poor so they speculate and engage in quick-buck schemes, economy becomes "volatile and vulnerable."

Raising the minimum wage is at the center of a set of policies. It is one part of what to do if we want economy to work again for regular people and for the future. Other parts include but are not limited to:

- New tax brackets for higher incomes,

- restoring the estate tax,

- restoring corporate taxation,

- getting rid of tax incentives that encourage corporations to move jobs and factories and profit centers out of the country,

- possibly a wealth tax to address the deficit and debt,

- a tax on Wall Street speculation,

- restoring government services that help lower- and middle-income people obtain affordable higher education and get job training,

- renegotiating trade deals that pit American workers against exploited, underpaid workers in non-democracies, thereby making American democracy and wages a competitive disadvantage

- and many other steps to address the changes brought in since the "Reagan Revolution" that drove the huge increase in inequality and decrease in government investment in our economy's future.

Raising the minimum wage is not only the moral thing to do, it is essential to bringing the low end up and start distributing the gains more fairly.

Even Walmart's Sales Hurting Now

After the economic crash Walmart was ascendant. More and more people were moving down the income ladder toward the bottom, they were moving from the upper-scale stores to the bottom, i.e. Walmart.

But now so many people have fallen below the bottom that even Walmart's sales are slowing down. Seeking Alpha recommends a SELL on Walmart stock because,

WMT derives most of its revenues from domestic operations in the U.S. where it has a dense network of stores and logistic centers. However, U.S. growth has almost flattened over the last couple of years eking out a yearly growth rate of just 1 percent.

Walmart can't just raise wages on their own because that will give their competitors an advantage, and soon we'll all be complaining about Target instead.

Even Walmart needs someone to come along and force wages up. Who could that someone be? It's up to government – We the People – to make all employers raise wages so they can all have customers again.

Government Needed

All businesses will tell you that if they didn't do everything they can to boost profits, someone else will, and then they're screwed. Business is a cut-throat game and you have to fight to survive. You have to fight as dirty as the rules let you fight. Businesses will tell you that if they don't keep wages as low as possible, deny health insurance, cut safety costs, cheapen products, and everything else they can get away with they will be gone, replaced by businesses that will.

The key to the equation is the "what the rules allow" and the "what they can get away with" part of that dirty fight. Businesses compete on a playing field, and the rules and enforcement of those rules determine the way the game is played.

Every individual business wants to save on labor and other costs. But if all businesses do the same, the result is that no one has any money to spend and all of those businesses are in trouble. This is where government comes in. Government is the essential part of this equation, setting and enforcing the rules in ways that make up for what inevitably happens if all businesses cut wages, costs, etc. And government is essential for enforcing those rules.

From "You Can’t Have Healthy Businesses Without Strong Government":

Imagine this, though it might be difficult: some people are greedy and want more for themselves, at the expense of the rest of us. Yes, this is shocking, but true!

Government protects us from those who would take advantage and take too much. Government does this both domestically and internationally. At home it protects us from criminals and exploiters. Government also protects us from physical and economic threats from other countries.

[. . .] When too many business reduce costs by cutting employees or paying less, the system collapses from lack of demand. Government is needed to keep businesses from laying off too many people or cutting pay. Sometimes government does this by stepping in and hiring people (or just giving them money like unemployment benefits), or buying things, thereby creating demand, causing businesses to hire.

Crucial to this equation:

When government is strong we have more enforcement of a level playing field for all of us, more education for all of us, more security for all of us, more protection of our environment, more infrastructure so our own startup businesses can flourish and compete, more parks, more promotion of the general welfare.

And when government is weak we end up with a very few greedy, ruthless billionaires and their giant corporations controlling the economy, stifling competition, scamming and defrauding us, and consuming the environment and resources for their own short-term profit.

Sign a SignOn.org petition posted by the Campaign for America’s Future calling for “the leaders of the House and Senate to allow an up-or-down vote on the Fair Minimum Wage Act of 2013, which would raise the minimum wage to $10.10 an hour and then index it to inflation.”

It is the nature of our current economic system that things will concentrate into fewer and fewer hands. When you let the ones with more money win the game and set the rules it is inevitable that they will increasingly set the rules to they always win the game. When the winner gets more stuff, eventually a very few winners have to end up with all the stuff.

The Fair Minimum Wage Act

The Fair Minimum Wage Act is up before the Congress. Isaiah J. Poole explains in Time To Demand A Vote To Increase The Minimum Wage:

The Fair Minimum Wage Act would increase the current federal minimum wage, $7.25, to $10.10 in three steps over a three-year period, and then index it annually to inflation from that point forward.

The bill would make an even more significant difference for tipped workers, mostly in the restaurant industry. They currently have a minimum wage of $2.13 an hour that has not increased since 1991. Under the bill, tipped workers would earn a minimum 70 percent of the regular minimum wage.

... House members have in fact had one opportunity to vote on the bill in March, in the form of a motion instructing the House to add the minimum wage increase to a workforce training bill. The motion was unanimously rejected by House Republicans.

The bill, though, deserves a stand-alone vote in its own right. It’s been three years since the minimum wage went up to $7.25, and that increase did not undo the damage done to low-wage workers by decades of congressional failure to keep this wage floor from sinking.

Sign a SignOn.org petition posted by the Campaign for America’s Future calling for “the leaders of the House and Senate to allow an up-or-down vote on the Fair Minimum Wage Act of 2013, which would raise the minimum wage to $10.10 an hour and then index it to inflation.”

-----