Republicans insist on cutting and gutting the things government does to make our lives better because, they say, "we're broke." Meanwhile a new study by Congress’ Government Accountability Office (GAO) shows that in 2010 the big U.S. companies paid only 12.6% in taxes on their reported worldwide profits. Corporate taxes have gone from 5-6% of GDP down to only a third of that. The corporate share of all taxes paid has gone from 28% to a third of that, too. And these lower taxes have hurt, not helped our economy and country.

Republicans Say "We're Broke"

Republicans say we have to cut spending on schools, infrastructure, research, cancer clinics, everything government does to make our lives better because "we're broke."

[fve]http://youtu.be/7xdsHP3Qb9U[/fve]

We aren't "broke." We are the richest country in history, but those riches are now being channeled to a very few people instead of shared among We, the People. This video will help you understand where the money went.

[fve]http://youtu.be/IkCWwpCCisI[/fve]

We are currently in year one of the "sequester." Even cancer clinics are forced to close. This follows trillions of dollars of other budget cuts. Our infrastructure if falling apart, bridges are falling down, our ancient power grid can't keep up with demand, our rail system system is like something in the third world compared to other countries, and at the same time we are experiencing extreme income and wealth inequality as more and more of everything goes only to a top few.

But hey, corporate taxes are low.

Corporate Taxes Lowest Ever

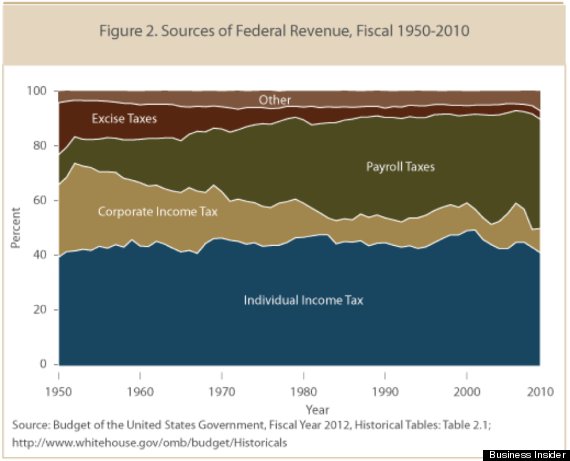

The corporate income tax rate is supposed to be 35%. It used to be 53 percent, then it was "reformed" to 46 percent, then it was "reformed" to 35%. And corporations used to pay 5-6% of GDP in taxes but now pay a third of that.

The corporate share of taxes paid has also dropped. According to the Center on Budget and Policy Priorities (CBPP), "The share that corporate tax revenues comprise of total federal tax revenues also has collapsed, falling from an average of 28 percent of federal revenues in the 1950s and 21 percent in the 1960s to an average of about 10 percent since the 1980s."

If corporations used to pay 28% of federal taxes and now they pay about 10%, see if you can guess who made up the difference? (Hint, it's you, through "payroll taxes.") This chart shows what happened:

But Wait, It's Even Lower!

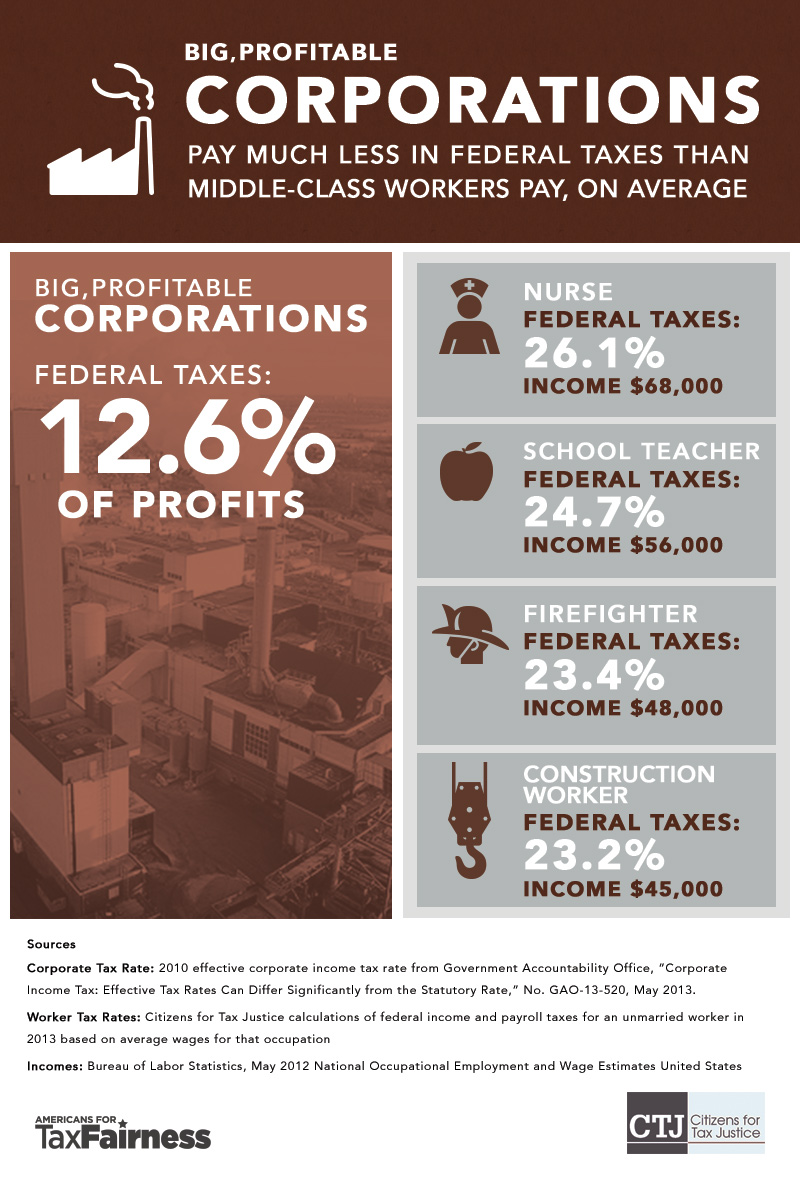

So the corporate tax rate, corporate tax as percent of GDP and share of the total tax burden kept dropping. But wait, it's even lower! A new GAO study shows that now the "effective" corporate tax rate -- the rate they are actually paying -- is only 12.6%!

This graphic from Americans for Tax Fairness shows how this compares to the tax rates paid by nurses, schoolteachers, etc. (click pic for larger)

Do Lower Taxes Grow The Economy?

Corporate conservatives argue that lowering tax rates grows the economy, but in fact the reverse happens. Here is a chart showing corporate tax rates and economic growth: (click for source)

Note that the economic growth rates go down along with tax rates. Maybe that's because lower taxes cause government cutbacks in the things democracy does for We, the People and our economy, like schools, infrastructure, research, etc.

But hey, the rich get fabulously richer.

Who Owns Corporation?

Who are we talking about when we learn that "corporations" only pay a 12.6% effective tax rate, and pay 1/3 of the tax burden that they used to pay?

In 2007 the wealthiest 1% owned 50.9% of all stocks, bonds, and mutual fund assets. If you expand to the wealthiest 10% they owned 90.3%. Meanwhile the next 80% of Americans owned 9.3% and among those the not-wealthiest 50% of Americans owned only one-half of one percent of these assets.

So when we are talking about corporate taxes we are really talking about taxes on the 1%.

How Are These Corps Paying So Little?

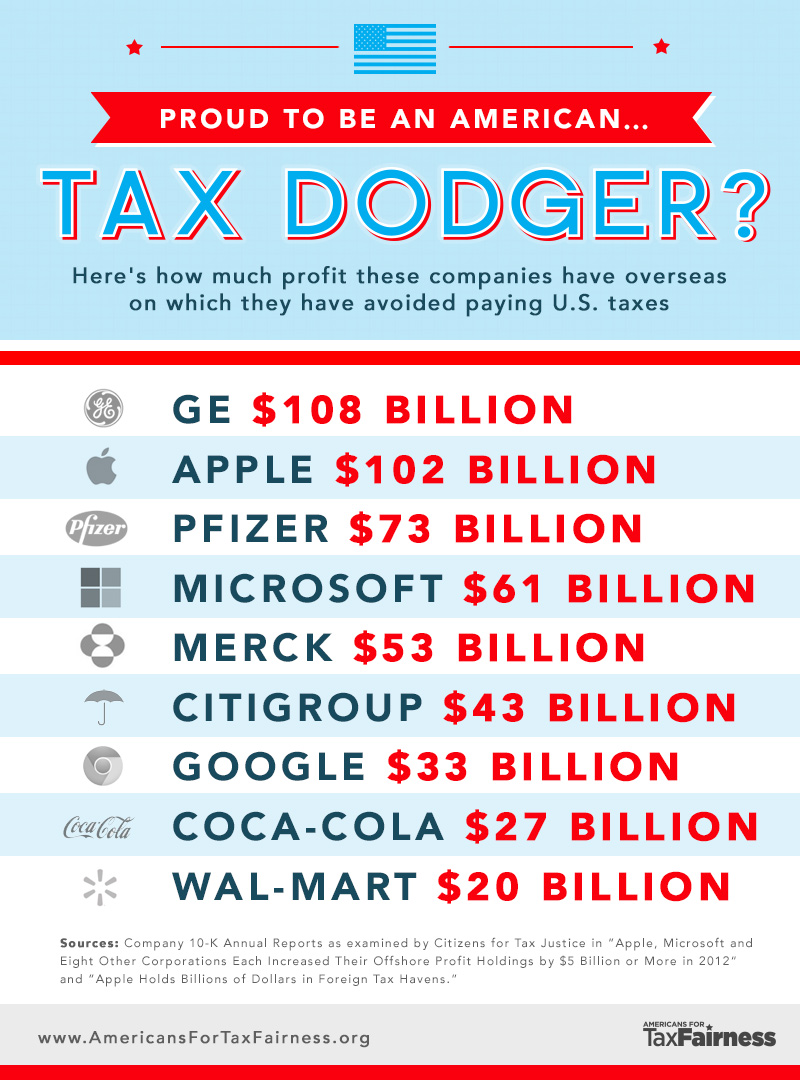

Aside from just paying off legislators to give them tax breaks, giant multinationals are holding their profits outside of the country because of a huge loophole in our tax code. They don't have to pay their taxes on foreign-made profits until they "bring the money home." So they don't bring it home, and they move jobs, factories and profit centers out of the country so they can transfer the appearance of profit-making outside the country, too. Currently giant corporations are holding between $1.7 $2 trillion outside the country, away from taxation sand away from their own shareholders!

Take a look at this from Americans for Tax Fairness, a coalition of "national, state, and local organizations united in support of a tax system that works for all Americans.": (click for larger)

See These Posts, Too

Richard Eskow's “Believe It or Not!”13 Mindblowing Facts About America’s Tax-Dodging Corporations

My Nine Pictures Of The Extreme Income/Wealth Gap

New “Pirates” Report On Corporate Tax Havens

A Better Way To Tax The Multinationals

Another Bridge Falls — Fixing Infrastructure Fixes Jobs And Deficits

Let’s Tell Multinational Corporations To Just Pay Their Taxes