The U.S. Census Bureau's Bureau of Economic Analysis released trade deficit figures this morning. We don't even bother to describe this as releasing trade figures anymore. In October, the overall U.S. international trade deficit in goods and services dropped a bit to $40.6 billion, down from a revised $43.0 billion in September.

October's monthly trade deficit in goods with China dropped a bit to $28.9 billion from a record high of $30.5 billion in September. But the year-to-date trade deficit with China is $267 billion. This is higher than last year's awesome yearly trade deficit of $261.6 billion.

The trade deficit with Japan went up to $6.4 billion in October from $5.5 billion in September.

What This Does To Working People

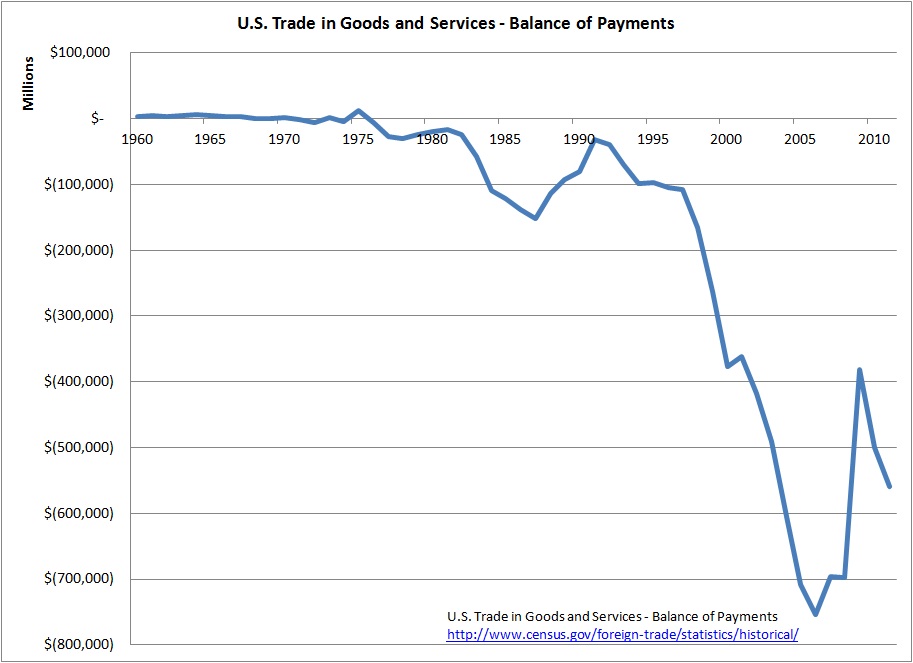

The US has run trade deficits since the late 1970s. This means that we buy more from other countries, particularly China, than we sell to them. Even when we increase exports we have increased imports more.

This trade deficit is jobs and dollars draining out of our economy. If we buy something made elsewhere it means the loss of a job making it here, and it means the money leaves the country. It also means that American workers are undercut in their ability to ask for raises because they are told "shut up or we'll move your job out of the country, too."

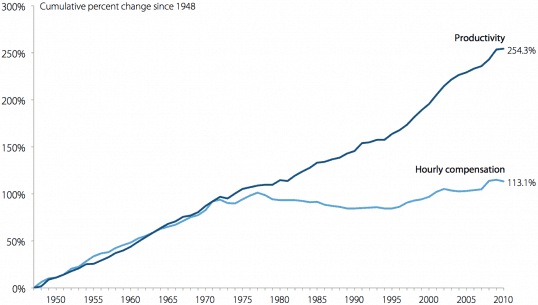

Is the trade deficit the cause of the "decoupling" of wages and productivity that has led to the decline of our middle class? (See 40% Of Americans Now Make Less Than 1968 Minimum Wage.)

Here is a chart that tracks our balance of trade.

Funny thing, this happens at the same time as working people stopped getting a share of the gains from growing productivity in our economy.

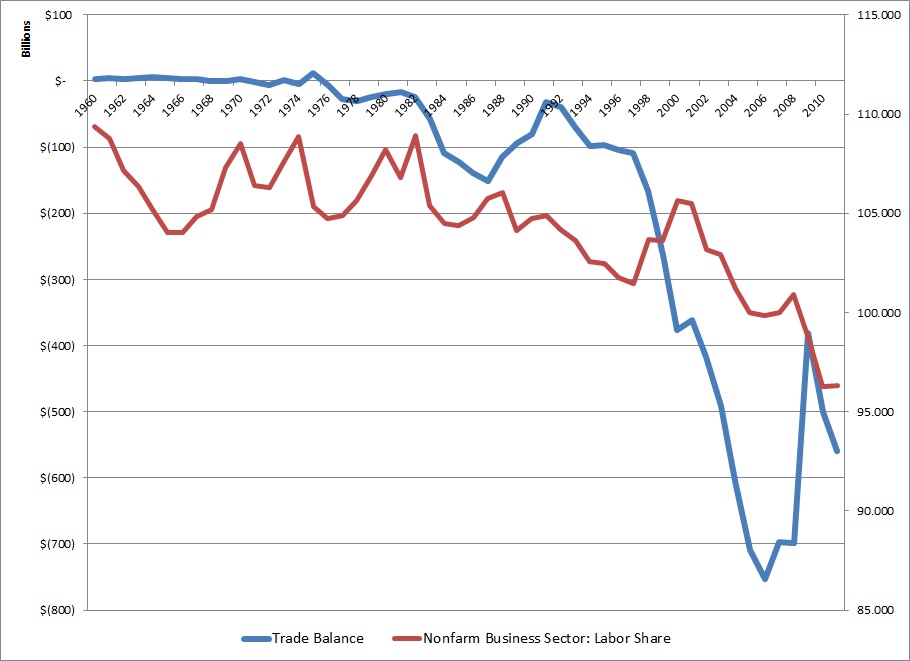

Finally, a chart of both the trade deficit and labor's share of the benefits of our economy.

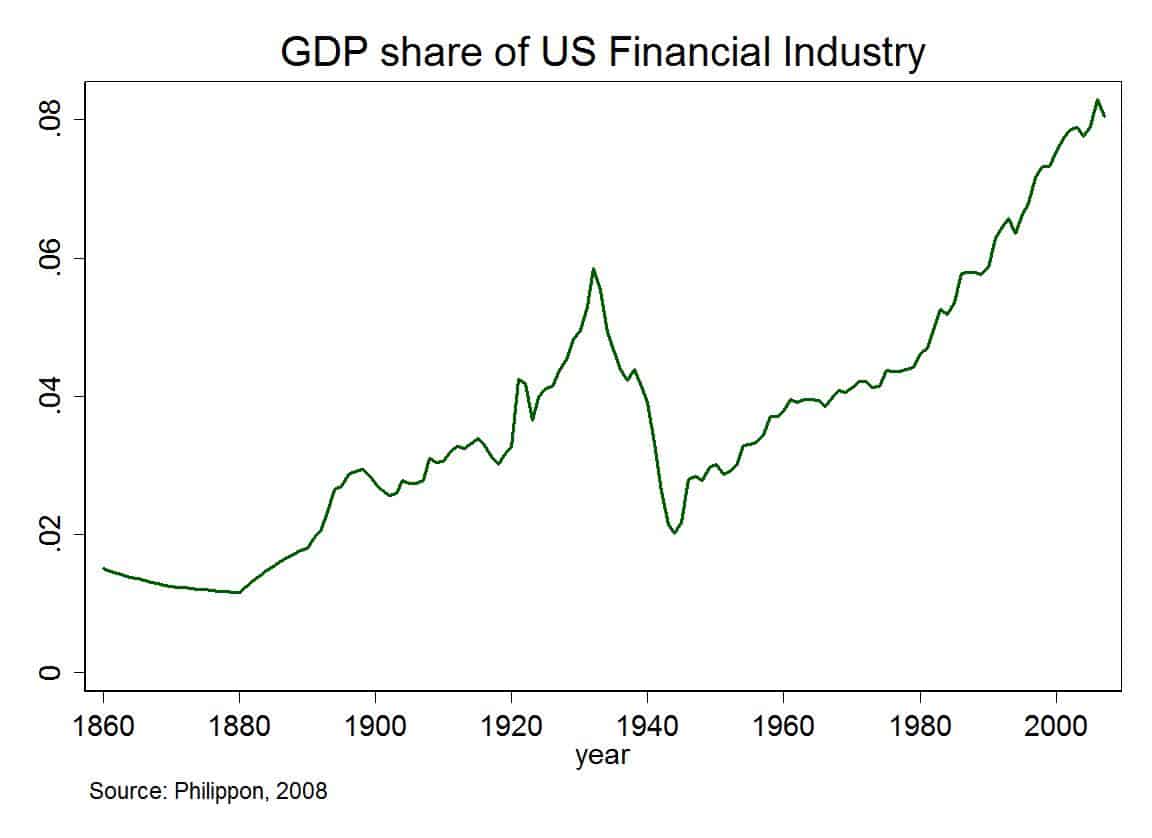

Now, for fun, find the same time period on this chart of Wall Street's share of the economy, and look at what happened at the same time as the trade deficit shot up.

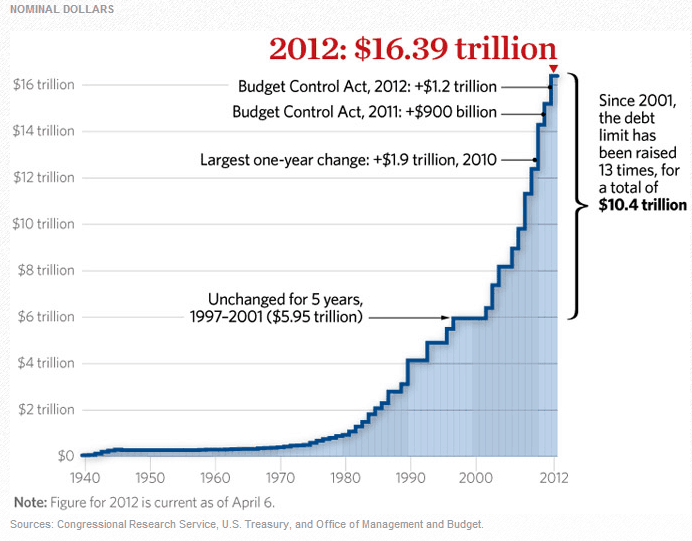

And for even more fun, here is a Heritage Foundation chart of the US debt. Note the dates.

Alliance for American Manufacturing (AAM) President Scott Paul commented on this month's trade deficit figures, pointing out that this helps finance China's military budget,

"One way that Beijing has been able to expand its military budget is through its accumulated trade surpluses with the United States. We’re right to complain about an air defense zone. But if we want China to know that we’re serious about challenging its aggressive behavior, we need to change our economic policies that have enabled it. Unfortunately, limiting our trade deficit with China seems to have fallen off of everyone's radar, including the Administration’s.

"As he visits Beijing this week, Vice President Biden should make clear that any effort toward a completed Trans-Pacific Partnership (TPP) with East Asian nations will only come to pass when the agreement firmly addresses the currency undervaluation that allows both China and Japan to continue to rack up trade surpluses each month.

"We are on pace toward another record annual trade deficit with China, alongside a rising trade deficit with Japan. Congress must strengthen the Administration's hand by passing currency legislation that already enjoys strong bipartisan support in both the House and Senate."