The deep pockets that make up America’s top 1 percent have been on quite a run. Their share of the nation’s wealth, as economist Gabriel Zucman details in a new Stanford Center on Poverty and Inequality analysis, has soared from 25 percent in the 1970s to 42 percent in 2012, the most recent year with slam-dunk data.

Might the outcome of the 2016 presidential election end that run? Maybe. Both candidates still standing in the Democratic Party primary race have proposed tax plans that would, if enacted, slow the top 1 percent wealth express. But the rates of slowdown the two candidates are proposing vary significantly.

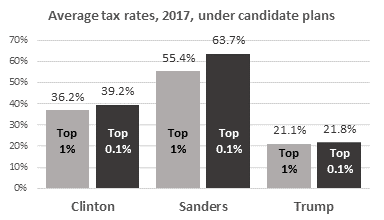

How significantly? The nonpartisan Tax Policy Center has just run the numbers for both the Hillary Clinton and Bernie Sanders federal tax plans.

The Tax Policy Center analysis brings into the mix all federal taxes. In other words, we’re taking not just federal income taxes here, but payroll taxes for Social Security and Medicare and federal estate and excise taxes as well.

For the top 1 percent — Americans with over $732,323 in income — the changes the Clinton campaign has proposed would shrink after-tax incomes an average 5 percent, an estimated $78,284 in 2017.

For the richest of America’s rich, the top 0.1 percent, the Clinton haircut would go a little closer. Taxpayers reporting over $3,769,396 in income would see their after-tax incomes drop by 7.6 percent, on average $519,741.

These drops in after-tax income would figure to irritate America’s most financially fortunate. But that irritation would likely turn to outright outrage if the Bernie Sanders proposals ever went into effect.

The tax rates here reflect the combined impact of all federal taxes, not just the federal income tax. Source: Tax Policy Center, Washington, D.C.

Under the Sanders plan, top 1 percent after-tax income would plummet 33.5 percent, a sink over six times steeper than the 5 percent dropoff in top 1 percent after-tax incomes under the Clinton plan. Sanders’ proposal would shear average top 1 percent incomes by $525,365 in 2017.

And the top 0.1 percent? America’s richest 116,000 taxpayers would see their after-tax incomes fall 44.8 percent, or $3,081,986, under the Sanders plan.

These super rich, of course, do have options. Plenty of candidates still chasing after a major party White House bid have no intention of irritating — let alone outraging — the nation’s most affluent.

Under Donald Trump’s tax plan, for instance, the after-tax incomes of the nation’s richest tenth of 1 percent would actually rise in 2017 — by an average 18.9 percent, the equivalent of $1.3 million.

That $1.3 million in one year’s tax savings just happens to add up to more money than most Americans get to earn in an entire lifetime.

Sam Pizzigati edits Too Much, the Institute for Policy Studies online monthly on excess and inequality. His latest book: The Rich Don't Always Win: The Forgotten Triumph over Plutocracy that Created the American Middle Class, 1900-1970 (Seven Stories Press).