A return to Eisenhower-era 90% top tax rates helps fix our economy in several ways:

1) It makes it take longer to end up with a fortune. In fact it makes people build and earn a fortune, instead of shooting for quick windfalls. This forces long-term thinking and planning instead of short-term scheming and scamming. If grabbing everything in sight and running doesn’t pay off anymore, you have to change your strategy.

2) It gets rid of the quick-buck-scheme business model. Making people take a longer-term approach to building rather than grabbing a fortune will help reattach businesses to communities by reinforcing interdependence between businesses and their surrounding communities. When it takes owners and executives years to build up a fortune they need solid companies that are around for a long time. This requires the surrounding public infrastructure of roads, schools, police, fire, courts, etc., to be in good shape to provide long-term support for the enterprise. You also want your company to build a solid reputation for serving its customers rather than cheapening the product, pursuing quick-buck scams, cutting customer service, etc. The current Wall Street/private equity business model of looting companies, leaving behind an empty shell, unemployed workers and a surrounding community in devastation will no longer be a viable business strategy.

3) It will lower the executive crime rate. Today it is possible to run scams that let you pocket huge sums in a single year, and leave behind the mess you make for others to fix. A high top tax rate removes the incentive to lie, cheat and steal to grab every buck you can as fast as you can. This reduces the temptation to be dishonest. If you aren’t going to keep the whole dime, why risk doing the time? When excessive, massive paydays are possible, it opens the door to overwhelming greed and a resulting compromising of principles. Sort of the definition of the decades since Reagan, no?

4) Combined with badly-needed cuts in military spending – we spend more on military than all other countries on earth combined – taxing the wealthy ends budget deficits and starts paying off the massive Reagan/Bush debt. This reduces and ultimately eliminates the share of the budget that goes to pay interest. The United States now has to pay a huge share of its budget just to cover the interest on the borrowing that tax cuts made necessary. Paying off the debt would remove this huge drag on our economy. (Never mind that Alan Greenspan famously called for Bush’s tax cuts by saying it was dangerous to pay off our debt – now that same Alan Greenspan says we need to cut benefits to retired people because our debt is so high.)

5) It will bring in revenue to pay for improvements in infrastructure that then cause the economy to explode for the better. Investing in modern transit systems, smart grid, energy efficiency, fast internet and other improvements leads to a huge payoff of increased prosperity for all of us – especially for those at the top income levels. Infrastructure improvement and maintenance is the “seed corn” of economic growth. We have been eating that seed corn since Reagan’s tax cuts.

6) (related) It will bring in revenue for improving our schools, colleges and universities. Not only will this help our competitiveness, but it will improve each of our lives and level of happiness.

7) It will boost economic growth and rebuild a strong middle class. A consumption-based economy does better when consumers have more to spend. Perhaps not cause-and-effect, though I suspect so, but after FDR raised top tax rates the economy grew dramatically. The 90% top rate years under FDR, Truman, Eisenhower and the beginning of the Kennedy years were the years when we built the middle class. And remember, after Clinton raised top tax rates only modestly the economy grew. How's it been doing since Bush's tax cuts for the rich?

A look at economic growth rate charts shows a steady decline in the decades since top tax rates began to fall. Is it just a coincidence that the economy booms after tax increases that provide revenue to invest in new “seed corn,” and that the economy declines as we reduce taxes?

8) It is good for business because increased revenue will enable increasing government spending for the benefit of regular people. This recirculates money into the economy more productively than the current system of putting huge fortunes into a few hands and hoping for a resulting consumption of high-end goods. The wealthy can only spend so muc h so more disposable income in the hands of regular people is good for business. Any business owner will tell you they want customers more than they want tax cuts. (Let’s wait until the top one percent no longer owns most of everything before we talk about whether there is an effect on investment.)

9) It protects working people. Exploiting workers with long hours, low pay or lack of pay increases, lack of worker protections, firing union organizers and schemes that call employees “contractors” will no longer pay off as it does today. The era of extreme union-busting came in at the same time as the tax cuts.

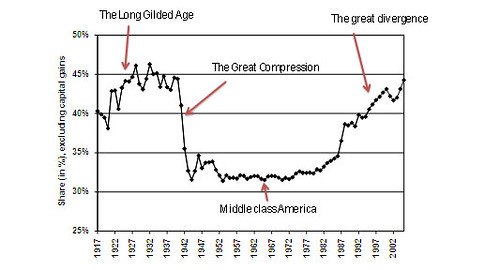

The chart shows the share of the richest 10 percent of the American population in total income – an indicator that closely tracks many other measures of economic inequality – over the past 90 years, as estimated by the economists Thomas Piketty and Emmanuel Saez.

10) It redistributes income and wealth in ways that help all of us. Currently a few people receive most of the income and own most of everything. A very high top tax rate reduces this concentration of wealth.

11) It fights the political instability that results from concentration of wealth. Great inequality in a society and the resulting loss of opportunity results in political instability that can lead to extreme ideologies, rebellion, etc. We are seeing all the signs of a resurgence of these problems today.

12) It will help rebuild our sense of democracy and belief in equality. As we have seen and are seeing, when too much is in the hands of too few, they have too much power and influence and use it to get even more.

13) It will strengthen the government that We, the People have worked hard to build, and strengthen its ability to enforce the laws and regulations that protect all of us and the resources we hold in common. It will increase its ability to provide all of us equally with the benefits of our joint efforts and our economy.

14) Finally, for good measure, increasing top tax rates will cause those affected to work harder to make up the difference. The Ayn Randians claim the very rich are the “producers” and all the rest of us are just parasites and slackers who feed off their “work.” So it will be very good for our economy to get them working harder by taxing them at 90%! You may have heard about those 25 hedge fund managers who brought in an average of $1 billion each last year – an amount that would have paid for 658,000 teachers -- while the rest of the country suffered through a terrible economy. If we had a top tax rate of 90% they would “only” take home $100 million or so each – in a single year. And we could have 658,000 more teachers. So it’s a win-win.

Taxes are how we all pitch in to enjoy the benefits and protections of modern society. Those benefits and protections are what enable people to become wealthy, and we ask that they give some back so others can prosper as well.